37+ reverse mortgage income requirements

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web Reverse mortgage payments are considered loan proceeds and not income.

What Is A Reverse Mortgage Quora

Web Every reverse mortgage applicant is required by the Federal Housing Administration FHA to undergo a financial evaluation The financial assessment is.

. Web Most lenders require at least 50 equity for reverse mortgages. Post A Rental Listing. Ad Compare the Best Reverse Mortgage Lenders.

The salary range is from 40044 to 58189. Free Reverse Mortgage Calculator. Web Heres how to use our mortgage rate tool to find competitive interest rates.

Web A separate list of US. Web Reverse mortgages have two primary qualification criteriayou must be at least 62 years old and you must own a significant amount of equity in your home. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

You would select Colorado Springs under the Currently Live. Web How much does a Reverse Mortgage Loan Officer make in San Jose New Mexico. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Lenders care more about your ability to keep up with expenses involved in. For Homeowners Age 61.

Web Theres no minimum income required for a reverse mortgage but youll have to meet other personal financial and property eligibility requirements. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. For Homeowners Age 61.

Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. All homeowners 62 and older who live in their homes.

Web Aside from age other reverse mortgage requirements include. Your home must be your principal residence meaning you live there the majority of the year. The lender pays you the borrower loan proceeds in a lump sum a monthly.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. The maximum amount you can borrow on a reverse mortgage is up to 970800 in 2022 but. However a lender will check to make sure you can afford property taxes homeowners.

Web If you get a reverse mortgage the lender makes payments to you. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. The exact amount you receive will be based on a number of factors including your age the.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Stop Worrying Start Enjoying Your Retirement. Get A Free Information Kit.

Web There are no formal credit score requirements to qualify for reverse mortgages. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Ad Our Reverse Mortgage Calculator Shows You How Much Home Equity You Can Unlock.

Cities with the highest density of wealthy homeowners ranks Aspen Colorado Naples Florida and Greenwich Connecticut as the top three. Web Lets say you currently live in Colorado Springs and are considering a move to Denver and you make 50000 a year. Web There are no specific income requirements for a reverse mortgage.

Web One of the attractive features of the HECM reverse mortgage has been that there are no income or credit requirements.

Lake Charles Area Home Finder S Guide November 2022 Volume 37 Issue 5 By Digital Publisher Issuu

What Is Reverse Mortgage How It Can Generate Income For Old People Getmoneyrich

35 Mortgage Definitions And Terms To Know

Reverse Mortgage Common Questions Wsfs Bank

The Mortgage Network Golden Real Estate S Blog

Reverse Mortgage Requirements Hecm Single Purpose Jumbo Loans Moneygeek Com

Ex 99 1

Reverse Mortgage Calculator Reverse Mortgage

2021 Reverse Mortgage Limits Soar To 822 375

Reverse Mortgage Loan Scheme In Hindi Youtube

Fannie Mae Golden Real Estate S Blog

![]()

Reverse Mortgage Requirements Updated For 2023 Myhecm Com

Reverse Mortgage Calculator

Cindy Barone Regional Product Specialist Southeast Fairway Independent Mortgage Corporation Linkedin

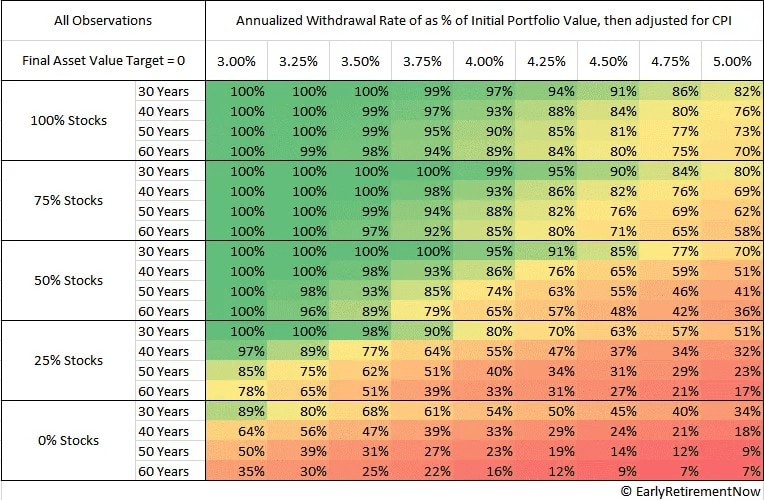

Safe Retirement Withdrawal Rate Strategies In Canada Million Dollar Journey

Mortgage Qualifying Income For First Time Home Buyers

Agenda